Robot-regulator Just Around the Corner?

Okay,

just kidding. :)

Introducing RBI AI – because understanding complex RBI regulations shouldn't feel like navigating a maze. With a simple question, you've got the power to unravel the answers you need.

Let's set the record

straight on AI.

The RBI AI is an assistant trained on historic RBI data from 1998 to Aug 2023.

Robot dance-off, woo!

A cyborg… with feelings?

Just throw your questions about money matters, and our guy gets you the answers.

You alright, AI?

Artificial

Intelligence

Machine

Learning

Deep

Learning

What is RBI AI?

Explain like I'm five.

Imagine RBI AI as a super-smart computer buddy for the bank. It helps the bank people make good decisions and understand complicated money stuff, like a really clever piggy bank that knows everything about coins and bills!

Wait,

complicated money stuff?

No worries! We taught our AI all about RBI's rules and money stuff, so now it's like having a super brainy friend who knows everything about how banks and money work.

So RBI AI is

like a money guru?

Absolutely! We fed RBI AI all the official rules and updates from RBI, so now it's like having a super knowledgeable friend who can explain all the money rules and changes to you.

Cool! I am only 5

is RBI a new concept?

Oh, it actually has quite

a history! I’ll show you!

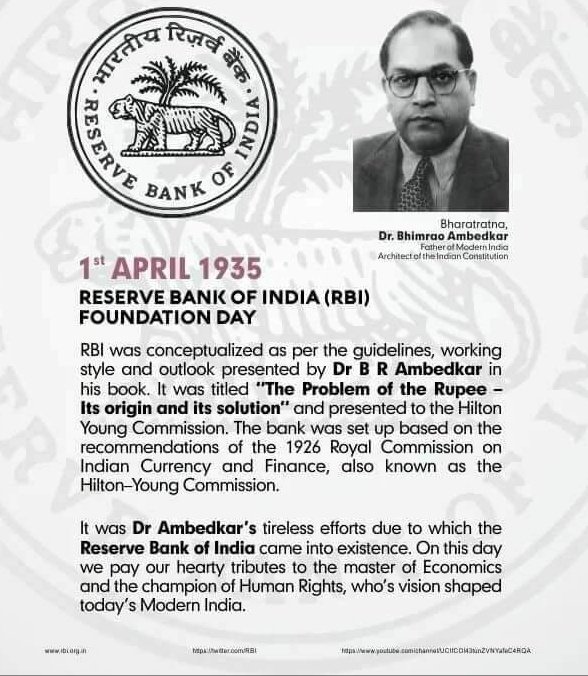

1935

Reserve Bank of India (RBI) came into existence today 1 April 1935. Guidelines laid down and presented by Babasaheb Dr B R Ambedkar before Hilton Young Commission.

1950

Nehru’s government set up a Planning Commission in 1950 which formulated the five-year plans

1969

Regional Rural Banks Act, the Narasimham Committee suggested setting up RRBs to give farmers and rural folks loans.

1982

National Bank for Agriculture and RuralDevelopment (NABARD) was established by an Act of theParliament.

1991

Launch of economic liberalization policies, opening up India's economy to globalization and foreign investment.

1993

Formation of the Securities and Exchange Board of India (SEBI) to regulate and oversee the securities market.

2014

Launch of the Pradhan Mantri Jan Dhan Yojana (PMJDY) to ensure financial inclusion by providing bank accounts to all citizens.

2016

Demonetization of high-denomination currency notes to curb black money and promote digital transactions.

2020

Announcement of the Atmanirbhar Bharat (Self-Reliant India) economic package to stimulate the economy.

2023

PM Modi takes ‘immense pride in RBI Governor Shaktikanta Das’ big achievement

Unlocking Insights with RBI AI: Your Trusted Financial Companion Elevate Your Banking Experience with Smart AI Assistance.

In addtion, Share your docs, school the AI. Ask, explore – answers will fly!

Bankers code: Aadhar, Balance, Compliance. Ours: Ask, Browse, Chill!

Ask a question and get answer from RBI docs with reference notification

you can also upload your own PDF, CSV, JSON....and chat with it

You're now a superstar!

Spoiler: this website was made in collaboration with AI

help me with Basel III norms?

Of course! The RBI circular you're referring to is RBI/2022-23/85 for Indian banks aims to ensure that banks maintain adequate capital to absorb losses and promote financial stability.

Certainly! RBI mandates banks to maintain a minimum common equity Tier 1 capital of 4.5%, a Tier 1 capital of 6%, and a total capital adequacy ratio of 11.5%. It covers risk-weighted assets, capital buffers, and various aspects of capital calculation.

can you summarize key requirements?

SEBI circular on insider trading?

The SEBI circular SEBI/HO/ISD/ISD/CIR/P/2022/14 addresses key aspects like trading plans, disclosures, and trading window restrictions for insiders ensuring transparency and minimizing information asymmetry.